Pvm Accounting Things To Know Before You Get This

Pvm Accounting Things To Know Before You Get This

Blog Article

Pvm Accounting for Dummies

Table of ContentsNot known Factual Statements About Pvm Accounting Pvm Accounting Can Be Fun For EveryoneHow Pvm Accounting can Save You Time, Stress, and Money.The Main Principles Of Pvm Accounting See This Report on Pvm AccountingThe Single Strategy To Use For Pvm AccountingThe Single Strategy To Use For Pvm AccountingThe 10-Second Trick For Pvm Accounting

One of the primary factors for applying bookkeeping in building and construction tasks is the requirement for monetary control and administration. Accountancy systems give real-time understandings right into project expenses, profits, and profitability, making it possible for job managers to promptly determine prospective issues and take rehabilitative actions.

Bookkeeping systems enable companies to keep track of capital in real-time, guaranteeing adequate funds are readily available to cover expenditures and meet monetary obligations. Efficient capital administration aids prevent liquidity dilemmas and keeps the project on the right track. https://trello.com/w/pvmaccount1ng. Construction projects undergo different economic requireds and reporting needs. Appropriate accounting guarantees that all monetary deals are recorded accurately which the job follows bookkeeping criteria and legal agreements.

The 20-Second Trick For Pvm Accounting

This minimizes waste and boosts project efficiency. To much better recognize the value of accounting in construction, it's likewise necessary to distinguish in between construction administration audit and job management accountancy.

It concentrates on the economic elements of individual building and construction tasks, such as expense estimate, expense control, budgeting, and capital administration for a particular task. Both kinds of accounting are essential, and they match each various other. Building and construction management accountancy ensures the business's financial health and wellness, while project administration bookkeeping makes certain the economic success of specific projects.

The 5-Minute Rule for Pvm Accounting

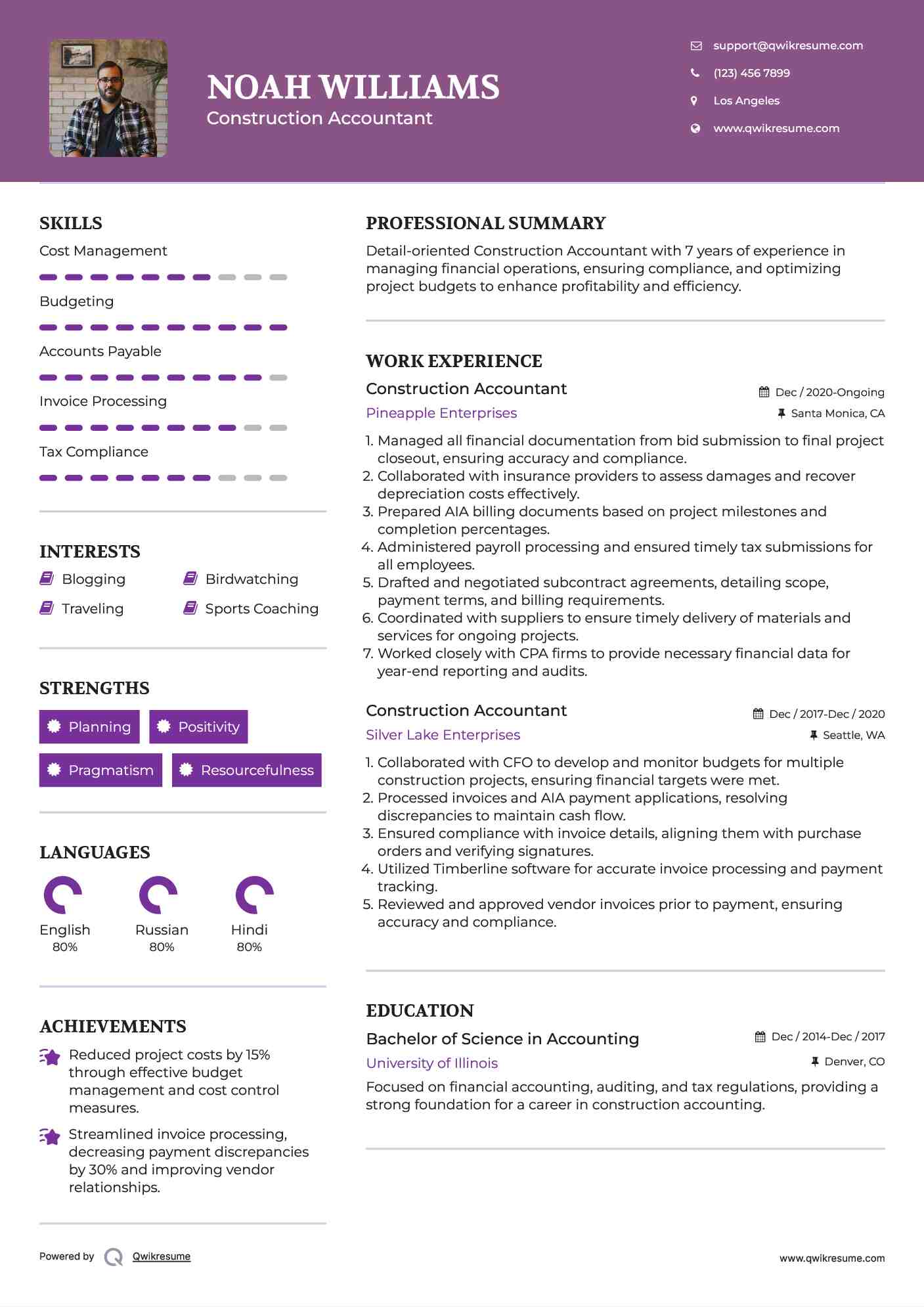

A crucial thinker is called for, that will certainly work with others to choose within their locations of duty and to surpass the locations' job procedures. The setting will communicate with state, university controller staff, campus department team, and academic researchers. He or she is expected to be self-directed once the initial understanding curve is overcome.

The 20-Second Trick For Pvm Accounting

A Building Accountant is in charge of handling the economic facets of building and construction projects, including budgeting, expense monitoring, economic reporting, and conformity with regulatory demands. They function closely with job supervisors, professionals, and stakeholders to make sure exact monetary documents, price controls, and timely repayments. Their competence in building and construction audit principles, job costing, and financial evaluation is essential for effective financial administration within the building sector.

The smart Trick of Pvm Accounting That Nobody is Talking About

Payroll tax obligations are taxes on an employee's gross income. The revenues from payroll taxes are made use of to money public programs; as such, the funds collected go straight to those programs rather of the Internal Revenue Solution (INTERNAL REVENUE SERVICE).

Note that there is an additional 0.9% tax obligation for high-income earnersmarried taxpayers who make over $250,000 or solitary taxpayers making over $200,000. Revenues from this tax obligation go toward federal and state joblessness funds to help workers that have actually lost their work.

The Best Guide To Pvm Accounting

Your deposits have to be made either on a regular monthly or semi-weekly schedulean election you make prior to each schedule year (Clean-up bookkeeping). Monthly settlements - https://www.huntingnet.com/forum/members/pvmaccount1ng.html. A month-to-month payment has to be made by the 15th of the complying with month.

Take care of your obligationsand your employeesby making total payroll tax obligation repayments on time. Collection and repayment aren't your only tax obligations.

9 Easy Facts About Pvm Accounting Described

Every state has its very own unemployment tax obligation (called SUTA or UI). This is because your company's industry, years in service and unemployment background can all figure out the portion utilized to compute the quantity due.

Pvm Accounting Things To Know Before You Get This

The collection, compensation and coverage of state and local-level taxes depend on the federal governments that impose the tax obligations. Clearly, the subject of pay-roll tax obligations includes plenty of moving components and covers a vast range of accountancy expertise.

This directory internet site uses cookies to enhance your experience while you navigate with the site. Out of these cookies, the cookies that are categorized as required are stored on your web browser as they are necessary for the working of fundamental functionalities of the site. We likewise utilize third-party cookies that assist us examine and comprehend how you use this website.

Report this page